Euphoria managed to out-run swine flu last week as the epidemic-du-jour, with “consumer” confidence jumping and the big bank stocks nudging up. The H1N1 virus fizzled for now, at least in terms of kill ratio, though we’re warned it might boomerang in the fall with a vengeance. No one was surprised to see Chrysler roll over like a possum on a county highway, but the memory of their muscle cars will linger on like a California surfing song. Here in the northeast, where Sundays are not spent at the Nascar oval, the spring foliage reached the tenderly explosive stage and it was hard to feel bad about anything.

For now, the “bottom” is in — that is, the bottom of this society’s ability to process reality. It may continue for a month of so, even after the “stress test” for banks is finally let out of the massage parlor with a “happy ending.” But events are underway that are beyond the command of personalities. We’re done “doing business” in all the ways that we’ve been used to, but we just can’t get with the new program. Let’s count the ways:

1. The revolving credit economy is over. It’s over because we can’t increase energy inputs to the system, which is one way of saying “peak oil.” Of course hardly anybody believes this right now because the price of oil crashed nine months ago, along with global manufacturing and trade. But nothing has changed on the peak oil scene — except perhaps that ever more new oil projects have been cancelled for lack of financing, which will boomerang on us (even if swine flu doesn’t) in the form of much lower future oil production. In any case, the credit fiesta is over, and the “consumer” economy with it, because industrial growth as we have known it is over. It’s over globally, too, though all regions of the world will not experience its demise the same way at the same rate.

The Asian nations may swap things around a while longer but China is basically screwed. They have less oil left than we have (which is saying, not much at all) and they won’t corner the rest of the global oil market without starting World War Three. Meanwhile, they’re running out of water and food. Good luck becoming the next global hegemon. Oh, and Japan imports 90 percent of its energy; India over 80 percent. Fuggeddabowdit.

Credit will not vanish everywhere overnight — even in the USA — because it is not distributed equally everywhere. But it will vanish in layers, and here in the USA a very broad layer of the lower and middle classes are now losing their access to it in one way or another — personally, in small business — and they will never get it back. Anyone who intends to thrive in the years just ahead had better plan on doing it on the basis of accounts receivable — and what they receive might not even necessarily come in the form of US dollars. It may come in the form of gold or silver or in the promise of reciprocal services rendered.

This has enormous implications for two of the items in which our credit-dispensing operations are most deeply vested: houses and cars. Unfortunately, these are exactly the things that economic life has been based on for decades in our nation, which leads to the next categories:

2.) The suburban living arrangement is over, along with all its accessories and furnishings. Taken as “all of a piece,” the suburban expansion was one sixty-year-long orgasm of hypertrophy. We did it because we could. We won a world war and threw a party. We had lots of cheap land and cheap oil. It made lots of people lots of money and all its usufructs have become embedded in our national identity to the dangerous degree that the loss of them will provoke a kind of national psychotic breakdown. In fact, it already has. The completely unrealistic expectation that we can resume this way of life is proof of it.

The immediate problem is that we can’t build anymore of it. The next problem will be the failure of the stuff that already exists. The first stage of that is now palpable in the mortgage foreclosure fiasco and, just beginning now, the tanking of malls, strip centers, office parks and other commercial property investments. The latter will accelerate and become visible very quickly as retail tenants bug out and weeds start growing where the Chryslers and Pontiacs once parked. The next stage, which involves large demographic shifts in how we inhabit the landscape, has not quite gotten underway.

3.) The Happy Motoring fiesta is over. You’d think that with Chrysler crawling into the bankruptcy court, and GM just weeks away from the same terminal ceremony, the news media would begin to suspect that the foundation of everyday life in this country was cracking. Instead, all we hear is blather about “market share” shifting to Toyota. News flash: not only will we make fewer automobiles in the USA, but Americans will buy far fewer cars made anywhere. We’ll keep the current fleet moving a while longer, but when it’s too beat to repair, we won’t be changing it out for a new fleet — despite all the fantasies about hybrids, plug-and-drive electrics, and so on. The masses will be too broke to buy these things. What’s more, they will be very resentful of the shrinking economic “elite” who can afford them. And, anyway, our roads and highways are destined to fall apart very quickly because there is no way we can sustain the necessary rate of normal maintenance. Meanwhile, we remain completely un-serious about public transit — even about fixing the vestiges that still exist. The airline industry, of course, will be toast inside of five years.

4.) Our food production system is approaching crisis. There’s no way we can continue the petro-agriculture system of farming and the Cheez Doodle and Pepsi Cola diet that it services. The public is absolutely zombified in the face of this problem — perhaps a result of the diet itself. President Obama and Ag Secretary Vilsack have not given a hint that they understand the gravity of the situation. It is probably one of those unfortunate events of history that can only impress a society in the form of a crisis. It also happens to be one of the few problems we face that public policy could affect sharply and broadly — if we underwrote the reactivation of smaller, local farm operations instead of shoveling money to giant “agribusiness” (or Citibank, or Goldman Sachs, or AIG…). I maintain that this may be the year that the crisis gets our attention, because capital is suddenly harder to get than fossil-fuel-based fertilizer.

All these epochal discontinuities present themselves, for the moment, as a season of muted “hope” and general apathy. The days are suddenly mild. We’ve resumed old and happy habits of grilling meat outdoors and motoring to those remaining places that were not blanketed with franchised food huts and discount malls. We have a new, charming president with an appealing family. Newly-minted dollars are flowing to the “shovel-ready.” The new bad news is less bad than the old bad news (or seems to be). And the year just past has been such a bummer that our hard-wired human nature tells us that good things must be just around the corner.

Personally, I think a lot of good things await us, but not the ones we’re expecting — not a return to buying slurpees on credit cards. It will be very salutary to leave behind the junk empire we’ve accumulated and move into an epoch of quality and purpose. For the moment, though, our hopes reside elsewhere.

____________________________________?

My 2008 novel of the post-oil future, World Made By Hand, is available in paperback at all booksellers.

This blog is sponsored this week by Vaulted, an online mobile web app for investing in allocated and deliverable physical gold. To learn more visit:Kunstler.com/vaulted

|

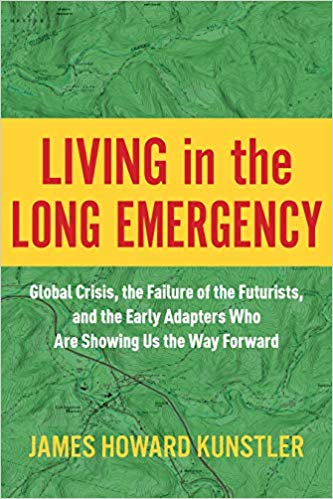

Order now! Jim’s new book Click here for signed author copies from Battenkill Books

|

Order now! Jim’s other new book |

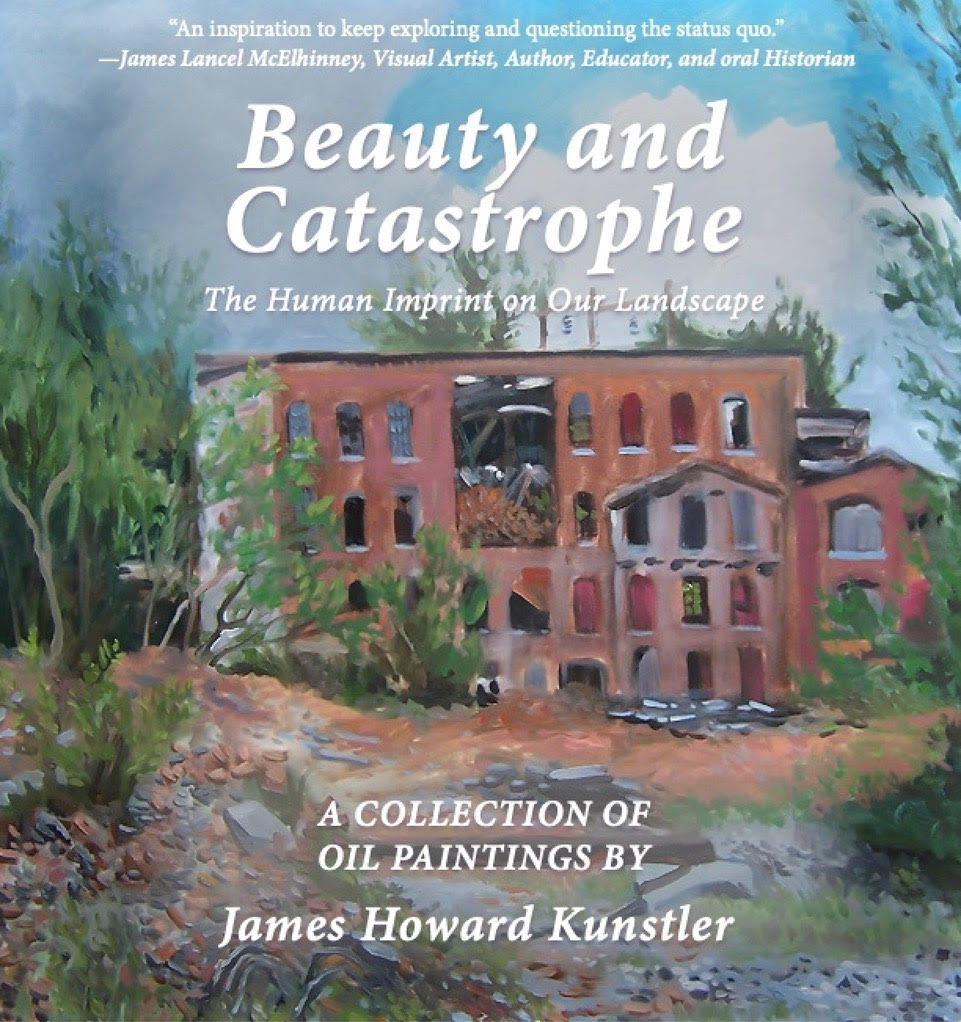

Paintings from the 2023 Season

New Gallery 15

GET THIS BLOG VIA EMAIL PROVIDED BY SUBSTACK

You can receive Clusterfuck Nation posts in your email when you subscribe to this blog via Substack. Financial support is voluntary.

Sign up for emails via https://jameshowardkunstler.substack.com

JHK’s Three-Act Play

JHK’s Three-Act Play

We are very lucky to know these precious things. Here I know more interesting information, giving me background knowledge. A good website, keep it up, I hope it lasts a long time. cookie clicker

Write an essay yourself, but an article on GradeMiners will help you write the best essay that can impress everyone, and you can always order an essay and they will do everything for you.

Also, before registering, you need to learn more about the history and reputation of the company. We recommend reading articles about the service, as well as visiting forums mail order wife where users leave feedback. Here you can find out the pros and cons of mail order bride website. Pay attention to the number of negative reviews. If there are too many of them (more than 15%), and the security service does not try to solve the problem, refuse to register here.