At the risk of confirming my critics’ dumbest charge — that I am a “doomer” — the mandate of clarity requires me to ask:

to what state of affairs do we expect to recover? If the answer is a

return to an economy based on building ever more suburban sprawl, on

credit card over-spending, on routine securitized debt shenanigans in

banking, and on consistently lying to ourselves about what reality

demands of us, then we are a mortally deluded nation. We’re done with

that, we’re beyond that now, we’ve crossed the frontier and left that

all behind, and we’d better get our heads straight about it.

I maintain that there are countless constructive tasks waiting to

occupy us on a long national “to do” list for rebuilding a national

economy, but they are way different than the ones currently

preoccupying government and the mainstream media. The Obama White

House, Congress, and The New York Times

are hung up on exercises in futility — “rescuing” banks and insurance

companies that cannot be rescued (because they are hopelessly trapped

in “black hole” credit default swaps contracts), and re-starting a

“consumer” binge that was completely crazy in the first place, based,

as it was, on a something-for-nothing standard-of-living.

Meanwhile, if the buzz on the blogosphere is a measure of anything

— and I think it is — then a new consensus is forming out there about

where to start doing things differently. Unfortunately after less than

two months in office, President Obama finds himself awkwardly

behind-the-curve on this. It begins with the understanding that a

general bank rescue is hopeless and, going a step further, that the

people who caused the train wreck of “innovative” securities have to be

prosecuted. The public’s collective voice on this is muted but growing.

It has been muted by the general air of blackmail that the banks have

used to enthrall policy and opinion — the “too big to fail” idea — in

effect holding the nation’s future for ransom.

Last week, New York State Attorney General Andrew Cuomo hauled

Bank of America chief Ken Lewis into his office to explain who,

exactly, received an aggregate several billion dollars in bonuses late

in 2008 after the US Treasury forked over billions of dollars in TARP

money to his bank. That was a good start. Mr. Lewis, being lawyered-up

to the max, had the temerity to reply that answering the question would

compromise his ability to keep talented people in his employ. For that

impertinence alone, Mr. Lewis ought to be dragged over fifteen miles of

broken chardonnay bottles behind a GMC Yukon — but that is not how we

do things in American jurisprudence. To be more realistic, a simple

indictment would be in order, and then Mr. Lewis can answer this

question, and a few others, in the comfort of an air-conditioned

courtroom. Ultimately, that might lead to Mr. Lewis becoming the wife

of a bodybuilder in one of New York State’s houses of correction — a

just outcome that would go far in rejiggering the nation’s expectations

about how people in authority ought to behave. And such an outcome

might lead to the conviction of many other brides-to-be from the Wall

Street debutante pool.

Now it has come to light, just last week in the wake of AIG’s

latest bail-out, that previous AIG bail-out money to the tune of $50

billion was distributed to a set of banks including Goldman Sachs

(former employer of then Treasury Secretary Hank Paulson and then New

York Federal Reserve Governor Tim Geithner), plus Morgan Stanley,

Merrill Lynch, Mr. Lewis’s Bank of America, and a long list of European

banks with operations in the USA. Since the transactions took place in

New York State, the investigation of these irregularities alone could

solve the unemployment problem here if NY Attorney General Cuomo were

given a free hand in hiring staff to depose everyone involved —

including the hiring of caterers to bring in coffee and meals for

round-the-clock proceedings.

All of this raises another awkward question:

where is United States Attorney General Eric Holder in this situation?

Surely the federal statutes offer some grounds for inquiring about the

misuse of Treasury funds — and many other issues arising from Wall

Street’s stupendous orgy of misbehavior. What I’m hearing out in the

blogosphere is a growing clamor to call people to account before we are

really able to move on to the massive task-list that awaits us in

rebuilding our economy.

The bigger question for now is

whether any of these authorities will act effectively before the public

simply goes apeshit and starts burning down Greenwich, Connecticut. The

dangerous shift in public mood is liable to occur with shocking

swiftness, in the manner of “phase change,” where one moment you see a

bewildered bunch of flabby clown-citizens vacuously enraptured by

“American Idol,” and the next moment they are transformed into a

vicious mob hoisting flaming brands to the window treatments of a hedge

funder’s McMansion. The moment of opportunity for avoiding that outcome

is looking sickeningly slim right now.

Another thing that President Obama can set into motion anytime —

and pull himself back to the head of the curve of leadership — is to

either by executive order or by proposal to congress, shut down the

credit default swap system for a period of time while procedures are

drawn up to place all these dubious contracts in a “clearing” market,

where the holders of them will have to come clean about what they’re

sitting on. The lack of this procedure is allowing zombie banks to hold

the United States hostage for never-ending bail-out ransoms. None of

these banks are going to survive another six months anyway, so the

basic blackmail motif that the whole money system will collapse if

ransoms are not paid is a bluff that has to be called sooner or later

in any case. So Mr. Obama might as well get on with it.

Once these two matters are dealt with — an earnest start-up of

prosecutions and disabling the credit default swap blackmail racket —

then perhaps a stressed-out and impoverished public might be induced to

not go apeshit and instead get on with the mighty task of rebuilding

our nation along lines that have a plausible future.

____________________________________?

My 2008 novel of the post-oil future, World Made By Hand, is available in paperback at all booksellers.

This blog is sponsored this week by Vaulted, an online mobile web app for investing in allocated and deliverable physical gold. To learn more visit:Kunstler.com/vaulted

|

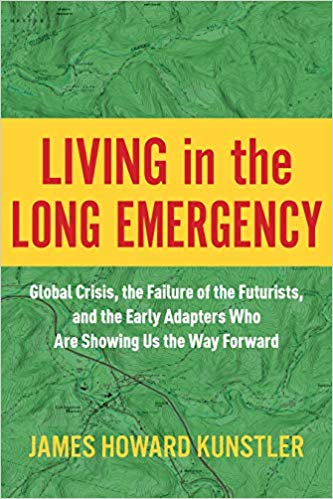

Order now! Jim’s new book Click here for signed author copies from Battenkill Books

|

Order now! Jim’s other new book |

Paintings from the 2023 Season

New Gallery 15

GET THIS BLOG VIA EMAIL PROVIDED BY SUBSTACK

You can receive Clusterfuck Nation posts in your email when you subscribe to this blog via Substack. Financial support is voluntary.

Sign up for emails via https://jameshowardkunstler.substack.com

JHK’s Three-Act Play

JHK’s Three-Act Play

I have learned a lot of information from your sharing, thanks a lot. Please continue sharing such interesting information. shell shockers unblocked