Forecast 2013: Contraction, Contagion, and Contradiction

The people who like to think they are managing the world’s affairs seem fiercely determined to ignore the world’s true condition — namely, the permanent contraction of industrial economies. They just can’t grok it. Two hundred years of cheap fossil fuel programmed mankind to expect limitless goodies forever on an upward-swinging arc of techno miracles. Now that the cheap fossil fuels have plateaued, with decline clearly in view, the hope remains that all the rackets of modernity can keep going on techno miracles alone.

Meanwhile, things and events are in revolt, especially the human race’s financial operating system, the world’s weather, and the angry populations of floundering nations. The Grand Vizier of this blog, that is, Yours Truly, makes no great claims for his crystal ball gazing (Dow at 4,000 – ha!), but he subscribes to the dictums of two wise men from the realm of major league baseball: Satchel Paige, who famously stated, “Don’t look back,” and Yogi Berra, who remarked of a promising rookie, “His whole future’s ahead of him!”

In that spirit, and as for looking back, suffice it to say that in 2012, the world’s managers — and by this I do not mean some occult cabal but the visible leaders in politics, banking, business, and news media — pulled out all the stops to suppress the appearance of contraction, and in so doing only supplied more perversion and distortion to the train of events that leads implacably to an agonizing workout, or readjustment of reality’s balance sheet. There’s a fair chance that these restraints will unravel in 2013, exposing civilization to a harsh new leasing agreement with its landlord, the Planet Earth.

On a personal note, I published a book in 2012 titled Too Much Magic: Wishful Thinking, Technology, and the Fate of the Nation. By an interesting coincidence, folks in the USA were engaged that year in manifold strenuous exercises in wishful thinking, ranging from fantasies of “energy independence,” to belief that central bank interventions could take the place of productive economic activity, to the idea that winks, suggestions, and guidelines were an adequate substitute for the rule of law, to the omnipresent mantra invoking “technology” as the sovereign remedy for every problem of existence (including the problems caused by technology), to the dominions of utter stupidity where climate change deniers hold hands with the funders of “creation” museums. Since wishful thinkers, by definition, are allergic to arguments against wishfulness, my book failed to make an impression. Anyway, gales of propaganda were blowing across the land, especially from the oil and gas fraternity, with the added cognitive dissonance hoopla of a presidential election — so the public was left wishfully bamboozled as it whirled around the drain of its hopes and dreams.

The Oil and Money Predicament

If you understand the basic formula that ever-increasing cheap energy resources were the fundamental condition for industrial growth for two centuries, then you must realize that they are also behind the modern operations of capital, especially the mechanism that allows massive volumes of interest on debt to be repaid — hence behind all of contemporary banking. And if you get that, it is easy to see how the end of cheap energy has screwed the pooch for modern finance.

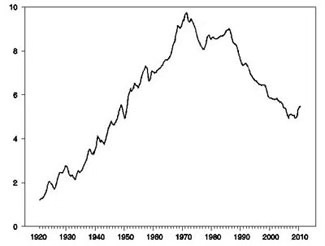

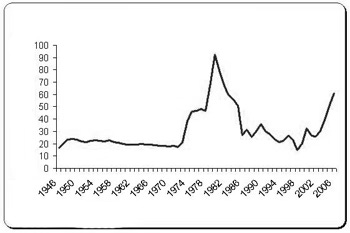

In fact, let’s step back for a panoramic view of what happened with that relationship in recent times: In 1970 you get American peak oil production at just under 10 mmbd (million barrels a day). This chart tells the story:

US Oil production 1920 to 2012

That event was little noted at the time, but by 1973, the rest of the world was paying attention, especially the OPEC countries led by the big exporters in the Middle East. All they had to do was look at the published production figures and by 1973 the trend was apparent. They apprehended that US production had entered decline — predicted by American geologist M. King Hubbert — and that they, OPEC, could now put the screws to the USA. Which they commenced to do during a decade of rather messy oil crises (messy because they were accompanied by geopolitical events such as the Yom Kippur War and the 1979 revolution in Iran). OPEC could put the screws to the USA because our still-growing industrial economy required a still-growing oil supply — the growth of which now had to be furnished by imports from other nations. The catch was that those other nations raised the price substantially, virtually overnight, and since everything in the US economy used oil in one way or another, the entire cost structure of our manufacture, supply, distribution, and retail chains was thrown askew.

The net effect for the USA was that our economy went off the rails for a decade and lots of strange things started happening in the financial sector. They called it “stagflation” — stagnant economic activity + rising prices. It was hardly a conundrum. The OPEC price-jackings of 1973 and 1979 made everything Americans had to buy more costly, in effect devaluing the dollar while throwing sand in the gears of industrial production. Meanwhile, dazed and confused American industry started losing out to Japan and Europe in things like electronics and cars. Price inflation was running over 13 percent in the late ’70s. Interest rates skyrocketed. When Federal Reserve chair Paul Volker aggressively squashed inflation with a punitive prime rate of 20 percent in 1981, the economy promptly tanked.

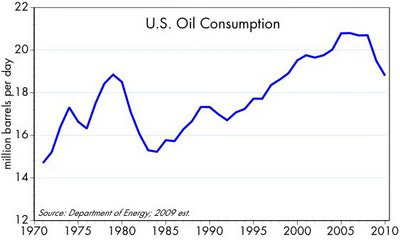

Now look at this chart:

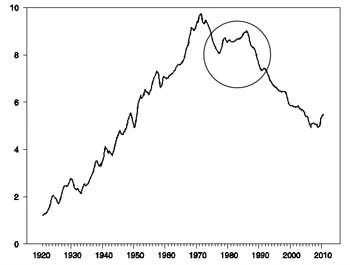

Notice that our oil consumption kept rising from the early 1980s until the middle of the early 2000s. Now look at the circle in the chart below. That rise of production from the late 1970s to about 1990 is mostly about production from the Prudhoe Bay oil fields in Alaska — one of the last great discoveries of the oil age (along with the North Sea and the fields of Siberia). US production did not regain the 1970 peak level, but it put a smile on the so-called Reagan Revolution and on Margaret Thatcher’s exertions to revive comatose Great Britain.

Post Peak Bump up from Alaskan Oil

Now look at the price of oil (chart below). You can see what a fiasco the period 1973 to 1981 was for US oil prices: huge rapid price rises in ’73 and ’79. But then the price started to fall steeply after 1981 and stayed around the same price levels as its pre-1973 lows.

1970s Oil Price Spike and Thereafter

The price of oil landed close to its pre-1973 levels by 1986 and hu

ng out there (though more erratically) until the mid-2000s. Because of those aforementioned last great giant oil field discoveries, OPEC lost its price leverage over world oil markets. Through the 1980s and 90s the price of oil went down until it reached the modern low of about $11 a barrel. That was when The Economist magazine ran a cover story that declared the world was “drowning in oil.” It was the age of “Don’t worry, be happy.”

The price behavior of the oil markets after 1981 had interesting reverberations in both the macro economy and the financial sector (which is supposed to be part of the macro economy, not a replacement for it). A consensus formed in business and politics that it was okay to yield manufacturing to other nations. It was dirty and nasty and caused pollution, so let other countries have it. We followed the siren call of clean and tidy forms of production: “knowledge work!” The computer revolution had begun in earnest. The financial sector began its metastasis from 5 percent of the economy to, eventually, 40 percent, and really cheap oil prompted the last great suburban sprawl-building pulsation into the Martha Stewart bedecked McMansion exurbs. In effect, financial shenanigans and sprawl-building became the basis for the vaunted “Next Economy.” It lasted about 20 years.

That incarnation of the US economy failed spectacularly as soon as oil prices started to creep up in the early 2000s. And, of course, the final suburban sprawl boom went hand-in-hand with all the shenanigans in banking. So when it all blew up, beginning in 2007 with the collapse of Bear Stearns, the USA was left with a gutted economy, insolvent banks, and a living arrangement with no future.

The Current Situation

We’re now entering the seventh year of a smoke-and-mirrors, extend-and-pretend, can-kicking phase of history in which everything possible is being done to conceal the true condition of the economy, with the vain hope of somehow holding things together until a miracle rescue remedy — some new kind of cheap or even free energy — comes on the scene to save all our complex arrangements from implosion. The chief device to delay the reckoning has been accounting fraud in banking and government, essentially misreporting everything on all balance sheets and in statistical reports to give the appearance of well-being where there is actually grave illness, like the cosmetics and prosthetics Michael Jackson used in his final years to pretend he still had a face on the front of his head.

The secondary tactic has been intervention in markets wherever possible and the intemperate manipulation of interest rates, all of which has the effect of defeating the principle purpose of markets: price discovery — the process by which the true value of things is established based on what people will freely pay. For instance the price of money-on-loan. The functionally less-than-zero percent interest rates on money loaned between giant institutions like central banks and their client “primary dealers” (the Too Big To Fails) essentially pays these outfits for borrowing, which is obviously a distortion in the natural order of things (because it violates the second law of thermodynamics: entropy) as well as an arrant racket. The campaign of intervention and manipulation also deeply impairs the other purpose of markets, capital formation, by the resultant mismanagement and misallocation of whatever real surplus wealth remains in this society. What’s more, it allows these TBTF banks to become ever-bigger monsters which hold everybody else hostage by threatening to crash the system if they are molested or interfered with.

Which brings us to the third tactic for pretending everything is all right: complete lack of enforcement and regulation by all the authorities charged with making sure that rules are followed in money matters. This includes the alphabet soup of agencies from the Securities and Exchange Commission to the Commodities Futures Trading Commission, to the Federal Housing Authority, and so on (the list of responsible parties is very long) not to mention the Big Kahunas: the US Department of Justice, and the federal and state courts. Aside from Bernie Madoff and a few Hedge Fund mavericks nipped for insider trading and arrant fraud, absolutely nobody in the TBTF banking community has been prosecuted or even charged for the monumental swindles of our time, while the regulators have behaved in ways that would be considered criminally negligent at best, and sheer racketeering at less-than-best, in any self-respecting polity. The crime runs so deep and thick through all the levels of money management and regulation that one can say the whole system has gone rogue, up to the President of the US himself, the chief enforcement officer of the land, who has not lifted a finger to discipline any of the parties involved. The fact that Jon Corzine, late of MF Global, is still at large says it all.

Fourth-and-finally, the news media in league with the public relations industry have undertaken a campaign of happy talk to persuade the public that everything is okay and all the machinations cited above are kosher so that there is absolutely no political agitation over these crimes against their own interest, which is to say, the public interest. The PR/media happy talk racket is also aimed at maintaining various subsidiary fictions about the economy, such as the fibs that the housing market is bouncing back, that “recovery” is ongoing, and that the channel-stuffing monkeyshines of the car industry amount to booming sales of new vehicles. Perhaps the most pernicious big lie is the bundle of fairy tales surrounding shale oil and shale gas, including the idea that America will shortly become “energy independent” or that we have “a hundred years of shale gas” as President Obama was mis-advised to tell the nation. It is pernicious because it gives us collectively an excuse to do nothing about changing our behavior or preparing for the new arrangements in daily life that the future will require of us.

The Shale Ponzi

Well, because that’s what it is: a Ponzi scheme, aimed at gathering in sucker-investors to boost share prices of oil and gas companies, with the hope that some miracle will occur to make financially broke societies capable of paying three or four times the price for oil and gas than their infrastructure for daily life was set up to run on, back when it seemed to be running okay. This is just not going to happen.

Let’s start with shale gas. The gas is there in the “tight” rock strata, all right, but it is difficult and expensive to get out. The process is nothing like the old conventional process of sticking a pipe in the ground and getting “flow.” It’s not necessary to go into the techno-details (you can read about that elsewhere) but to give you a rough idea, it takes four times as much steel pipe to get shale gas out of the ground. I have previously touched on the impairment of capital formation due to machinations in banking – themselves a perverse response to the loss of capacity to pay back interest at all levels of the money system, which was caused by the world’s running out of cheap oil and gas. (Note emphasis on cheap.) The net effect of all that turns out to be scarcity in another resource: capital, i.e. money, rather specifically money for investment in things like shale oil and gas.

Ironically, plenty of money was available around 2004-5 when the campaign to go after shale oil and gas got ramped up over premonitions of global peak oil. How come there was money then and not now? Because we were at peak cheap oil and hence peak credit back then, which is to say peak available real capital. So, the oil and gas companies were able then to attract lots of investment mon

ey to set out on this campaign. They brought as many drilling rigs as they could into the shale oil and gas play regions and they drilled the shit out of them. Natural gas was selling for over $13 a unit (thousand cubic feet) around 2005, and it was that high precisely because conventional cheap nat gas production was in substantial decline.

That was then, this is now. As a result of drilling the shit out of the gas plays, the producers created a huge glut for a brief time. They queered their own market long enough to wreck their business model. Unlike oil, nat gas is much more difficult to export — it requires expensive tankers, compression and refrigeration of the gas to a liquid, seaboard terminals to accomplish all that (which we don’t have), so there was no way to fob off the surplus gas on other nations. The domestic market was overwhelmed and there was no more room to store the stuff. So, for a few years the price sank and sank until it was under $2 a unit by 2011. Since shale gas production is just flat-out uneconomical at that price, the companies engaged in it began to suffer hugely.

In the process of all this a pattern emerged showing that shale gas wells typically went into depletion very quickly after year one. So all of the activity from 2004 to 2011 was a production bubble, aimed at proving what a bonanza shale gas was to stimulate more investment. It required a massive rate of continuous drilling and re-drilling just to keep the production rate level — to maintain the illusion of a 100-year bonanza — and that required enormous quantities of capital. So the shale gas play began to look like a hamster wheel of futility. After 2011 the rig count began to drop and of course production leveled off and the price began to go up again. As I write the price is $3.31 a unit, which is still way below the level where natural gas is profitable for companies to produce — say, above $8. The trouble is, once the price rises into that range it becomes too expensive for many of its customers, especially in a contracting economy with a shrinking middle class, falling incomes, and failing businesses. So what makes it economical for the producers (high price) will make it unaffordable for the customers (no money). Because of the complex nature of these operations, with all the infrastructure required, and all the money needed to provide it, the shale gas industry will not be able to go through more than a couple of boom / bust cycles before it begins to look like a fool’s game and the big companies throw in the towel. The catch is: there are no small companies that can carry on operations as complex and expensive as shale requires. Only big companies can make shale gas happen. So a lot of gas will remain trapped in the “tight” rock very far into the future.

Obviously I haven’t even mentioned the “fracking” process, which is hugely controversial in regard to groundwater pollution, and a subject which I will not elaborate on here, except to say that there’s a lot to be concerned about. However, I believe that the shale gas campaign will prove to be a big disappointment to its promoters and will founder on its own defective economics rather than on the protests of environmentalists.

Much of what I wrote about shale gas is true for shale oil with some departures. One is that the price of oil did not go down when US shale oil production rose. That’s because the amount of shale oil produced — now about 900,000 barrels a day — is working against the headwinds of domestic depletion in regular oil + world consumption shifting to China and the rest of Asia + the declining ability of the world’s exporters to keep up their levels of export oil available to the importers (us). We still import 42 percent of the oil we use every day.

The fundamental set up of life in the USA — suburban sprawl with mandatory driving for everything — hasn’t changed during the peak cheap oil transition and represents too much “previous investment” for the public to walk away from. So we’re stuck with it until it manifestly fails. (Life is tragic and history doesn’t excuse our poor choices.) The price of oil has stayed around the $90 a barrel range much of 2012. Oil companies can make a profit in shale oil at that price. However, that’s the price at which the US economy wobbles and tanks, which is exactly what is happening. The US cannot run economically on $90 oil. If the price were to go down to a level the economy might be able to handle, say $40 a barrel, the producers of shale oil would go broke getting it out of the ground. This brings us back to the fact that the issue is cheap oil, not just available oil. As the US economy stumbles, and the banking system implodes on the incapacity of debt repayment, there will be less and less capital available for investment in shale oil. As with shale gas, the shale oil wells deplete very rapidly, too, and production requires constant re-drilling, meaning more rigs, more employees, more trucks hauling fracking fluid, and more capital investment. This is referred to as “the Red Queen syndrome,” from Lewis Carrol’s Through the Looking Glass tale in which the Red Queen tells Alice that she has to run as fast as she can to stay where she is.

The bottom line for shale oil is that we’re likely to see production fall in the years directly ahead, to the shock and dismay of the ‘energy independence’ for lunch bunch. 2012 may have been peak shale oil. If the price of oil does go down to a level that seems affordable, it will be because the US economy has been crushed and America is mired in a depression at least as bad as the 1930s, in which case a lot of people will be too broke to even pay for cheaper oil. Hence, the only possibility that America will become energy independent would be a total collapse of the modern technological-industrial economy. The shale oil and gas campaign therefore must be regarded as a desperate gambit by a society in deep trouble engaging in wishing and fantasy to preserve a set of behaviors that can no longer be justified by the circumstances reality presents.

Macro-economic Issues

Major fissures began to show in the Ponzified global financial system in 2012 and it is hard to imagine them not yawning open dangerously in 2013. All the Eurozone countries are in trouble. Its collective economy has been tanking faster than the US economy because the member nations can’t print their own money and it is harder to conceal the financial tensions between debt accumulation and government expenditures. These tensions end up expressed as “austerity” — meaning fewer and fewer people get paid, which makes people angry and makes governments unstable. Bailout procedures are transparently laughable under the European Central Bank and the other bank-like “facilities,” giving money to governments so that they can give it to insolvent banks, so the banks can buy government bonds, which only stuff the banks with more bad paper, and take the national debts higher. Several Euro member countries are contenders for default this coming year: Greece, Spain, possibly Italy, and perhaps even France, which is now a basket-case dressed in Hollandaise sauce.

A perfect storm in the global bond market has formed with Europe crippled, Canada and Australia entering their own (long-delayed and spectacular) housing bubble busts, the USA sharply losing credibility as it fails to politically address its balance sheet problems — or even continue to pretend that it might — and Japan utterly floundering under a new lack of commitment to nuclear power, the need to import virtually all the fossil fuels it needs for its industrial economy, a consequent negative balance of trade (for the first time in decades), and a deadly debt-to-GDP ratio around 240 percent. Many observers see the new Japanese government under Shi

nzo Abe as determined to inflate his own currency away to nothing in an effort to unload exports and erase debt, and nobody understands how that strategy turns out well. My own view, expressed here before, is that Japan is on a fast track to become the first advanced nation to opt out of industrialism and go medieval. It might sound like a joke, but its not. And it would be consistent with Japan’s historic cultural personality of making stark choices, even if it was not clearly articulated in the political theater. The journey to that destination could include a war with China, which also would be consistent with Japan’s suicidal inclinations, so clearly displayed in its last major war with the US.

The global bond market is held together with baling wire and hose clamps. Since money is loaned into existence (in the words of Chris Martenson) the global financial system is underwritten by its bonds, and the bonds are underwritten only by the faith that issuers can pay the interest due to bondholders. Risk rises in an exact ratio as that faith wanes. And interest rates must rise hand-in-hand with that rising risk — unless the ruling authorities (central banks and governments) conspire to repress them. These “unnatural” interventions will only cause the trouble to be expressed elsewhere in collapsing currencies and economies. It is already happening under the various ZIRP regimes, setting up a feedback loop in which it becomes even less likely that bond-holders will be paid and more faith erodes until nobody wants any bonds and the market for them seizes up and all that paper becomes worthless.

These days, the only sovereign nation in the Eurozone with real financial credibility (i.e. tangible surplus wealth) is Germany. The European Central Bank has only a printing press and the European Financial Stability Facility only pretends to have access to pretend money. At some point, the Germans will have to decide whether they truly want to pick up the tab for all the unpaid bills of the Eurozone. Either they pay for life support for their customers or they let them go under and either way, they end up in the black hole of a contracting export economy, which is to say depression. Now, imagine Germany having to bail out France. Wouldn’t that be a moment of plangent historical symmetry? I’m not the only one to propose that Germany may shock the world in 2013 by pulling out of the Euro on short notice and taking shelter behind the Deutschmark. It may limit the damage, but otherwise they are stuck where they are geographically and as the other nations in Europe ride their economies down, Germany’s will contract, too.

One idea behind the Eurozone was to get its members so economically interdependent that war would be an unthinkable option. The period following the Napoleonic Wars (1815 – 1914) was exceptionally peaceful in Europe, too. Then, the 20th century rolled onstage with the unspeakable horror of two consecutive “world wars.” They occurred amid a phenomenal uptrend of increasing industrial wealth and burgeoning technology. Note that the defeat of the French army at Waterloo in 1815 was accomplished by a coalition of British and German (Prussian) forces. (The teams change through history.) Note also that the end of the long peace of the 19th century, the First World War, was a trauma the real cause of which continues to mystify the historians — did England, France, Germany care that much about Serbia to destroy their economies? The Second World War was an extension of the unresolved business of the first, especially the question of who owed what to whom for all the damage. One thing we do know: the world was not prepared for the consequences of industrial-strength warfare with high tech weapons: the massacres of the trenches, aerial bombing of cities full of civilians, and the assembly-line style crematorium.

The atom bomb finally sobered folks up in 1945. The ensuing period has been another age of peace and plenty in Europe. The next act there will be played out against the backdrop of declining wealth and unraveling techno-industrial complexity. It may be a set of low-grade grinding struggles rather than an operatic debacle like the two world wars, and it will surely include internal civil strife in this-or-that country, which could turn outward and become contagious. The next time Europe finds itself a smoldering ruin, the capital will not be there to rebuild it. I’m not sure whether it matters all that much whether the single currency Euro survives or not. Everything economic is hitting the skids in Europe now led by plunging car sales. Record high youth unemployment is epidemic, including now in France. The debt problems there can only be solved by deleveraging and/or default. The chance of coordinated cooperative fiscal discipline among the Euro member nations is nil. I see Europe poised to follow Japan into a re-run of the medieval period, though much less willingly. The quandary is: how do you have a wonderful and peaceful modern culture without an economy to support it.

The United Kingdom stands outside the Euro currency club (though it is in the European Union of trade agreements) but London remains the financial hub of the continent, if not the money-laundering center of the universe. The financial mischief there is allowed to go on because washing and rinsing money is the only major industry left in Old Blighty. Its own finances are in terrible disarray, the people have been subject to painful “austerity” for some time before the PIIGS started squealing, and its energy resources are dwindling away to nothing. The governing coalition of David Cameron’s Tories and the Nick Clegg’s Liberal Democrats is cracking up under the austerity strain, with Nigel Farage’s Independence Party creeping up in the polls. With the LIBOR scandal entering the adjudication phase, monkey business in the London gold and silver bullion market, and half the world’s daily churn of interest rate derivatives, “the City” (London’s Wall Street) is one black swan away from provoking a world-scale financial accident that could daisy-chain through all the world’s big banks and create a “nuclear winter” of capital. It’s too bad the UK didn’t keep making chocolate bars and those wonderful tin soldiers I played with as a child. Instead, the nation became a casino with a lot of excellent Asian restaurants. It is nicely positioned to be the whipping boy for the rest of Europe as everybody’s fortunes turn down, but it has enough military hardware to strike back and cause a whole lot more trouble. Imagine England becoming the Bad Boy of Europe in the 21st century, having to be disciplined now by the Germans!

Russia is a few wealthy cities in an enormous flat alternative universe of ice and fir trees. Perhaps global warming will perk up the long-suffering Russian people. Meanwhile, 50 percent of Russia’s economy is tied to its oil and gas production. Their great Siberian fields are petering out just like the Alaskan and North Sea giants that were discovered around the same time. They have been throwing huge numbers of drilling rigs into depleting fields to keep production up and pursuing some “tight” rock plays with help from the USA’s Halliburton and Schlumberger, with few environmental protests in the wilds of Siberia. I’m not persuaded that exploration for oil in the offshore Arctic region will have a great outcome. Where does the capital investment come from if every other advanced industrial economy is broke? Even if the sea ice melts it will be difficult and expensive to work in the Arctic seas, and the thawing permafrost of Siberia will leave an endless soggy patch of mosquito-infested mush between the offshore rigs and customers in Europe and elsewhere. Anyway, those customers will be increasingly impoverished and hard-pressed to pay for ever more pricey oil. The Russians may be hopeful that climate change will boost their crop yields and make their p

ortion of the earth comparatively more habitable — but it’s more likely that thawing permafrost will prang the entire human experiment.

There are fewer cheerleaders for China and its economic fortunes than a year or so ago, as deep problems in banking and politics reveal themselves, along with the troubles plainly visible in their slumping export markets. If people in the USA and Europe don’t buy all the flat screen TVs and plastic stuff then China is going to choke on industrial overcapacity. (It already is.) They have accomplished some marvelous things recently, especially compared to the cretinous lethargy of the USA — for instance, building a great continental high speed railroad line and a huge solar energy industry — but they face the same fundamental quandary as all the other industrial nations: declining fossil fuel resources with no comparable replacement on the horizon. Their positioning for the coming great contraction vis-à-vis the aforementioned advantages in solar and rail transport must be offset by an opaque, corrupt, and despotic political regime, a huge and potentially restive population of laid-off urban factory workers, and a chaotic banking system. They have laid in a lot of “reserves” in the way of US treasury paper and stockpiled much valuable construction material (steel, copper, cement, etc), but what does that really mean? If they dumped the treasuries, or even systematically divested, they could trash the bond market and the dollar. And what might they do with all the construction material in an economy with sinking demand for new buildings? Will they need more super-highways as the price of gasoline makes car ownership less affordable?

China appears to be accumulating big supplies of gold bullion — they have also become the world’s number one producer of mined gold, eclipsing played-out South Africa. That could give them a lot more room to maneuver in a world of vanishing resources and collapsing economies, at least in terms of being able to swap for food and fuel. They may be attempting to establish a gold-backed currency to replace the dollar for international trade settlements. Doings at the ASEAN Summit in November suggests they are engineering just such a new reserve currency for the world to run shrieking to when America’s foolishness and cowboy swagger becomes too much to take — though US dollar dominance was based as much on America’s (now bygone) rule of law in money matters as America’s sheer economic power, and China remains Dodge City where the rule of law is concerned. The world might not be so eager to be pushed around by the Yuan. But it may be accomplished by financial coup d’état whether the world likes it or not. My forecast for China in 2013 is a widening crack in the political façade of the formerly omnipotent ruling party, organized agitation by unemployed factory workers (with government blowback), bullying of their senile neighbor (and historical enemy) Japan, and sullen, peevish behavior toward their ailing trade partners, Europe and especially the USA. Worldwide economic entropy cancels out China’s putative advantages in cash reserves, stockpiles of “stuff,” and government that can do what it pleases without a loyal opposition tossing sand in its gears.

Contrary to the wishful thinking of Tom Friedman, globalism is winding down. The great contraction leads back to a regional and local reorganization of activity in all nations. The world becomes a bigger place again with more space between the players and a larger array of players as big nations break up into autonomous states. This is really a new phase of history, though it is only just beginning in 2013.

Outlying Territories

Literally anything can happen in the Middle East, up to the initiation of an event that resembles a world war. As a general proposition, there are just too many people inhabiting this region of the world and the political tensions among them reached critical mass in 2013. The meltdown will continue with enough critical frailty to prang the region’s oil exporting capacity, it’s main source of wealth and power. It just wouldn’t take much. King Abdullah of Saudi Arabia is pushing 90. His subjects are getting more numerous, collectively poorer, and more anxious about their future. The country is surrounded by failing regimes. I forecast overthrow of the Saud family’s long grip on power this year, with a struggle among other entitled families there and finally an Islamic revolution adding spice to the political upheaval.

I doubt that Israel will try to attack Iran’s nuclear factories without overt consent from the US government, which will be withheld from Israel, on account of the difficulties ongoing in the US economy.

Overall I expect gross deterioration of civil order, living standards, and oil export markets in the Middle East. The US will be foolish to intervene.

South America gets a little poorer, Argentina defaults again, but this continent remains a sleeping backwater in the world — perhaps proof that the hedge funders fleeing to sanctuaries in backwaters like Uruguay may have made a great call.

Mexico is the exception. Whatever economic and political sickness the US suffers will infect our neighbor to the south. Too many people there competing for not enough stuff. There will be blood (as the old movie title goes).

Turning 9,000 miles to the east, can Pakistan become a worse basket-case of a nation? I suppose they could, if taken over by their homegrown Islamic maniacs. India next door will be rocked by the great global economic contraction. The two countries, well armed with atomic bombs are a bad combo. Unfortunately, a distracted world cannot pay much attention.

Woe to Markets

Between government and central bank interventions, accounting fraud, control fraud, the computer hugger-mugger of algorithmic trading, and AWOL rule of law, the financial markets have practically destroyed themselves. They can’t be depended on to express the real value of things and capital formation struggles against the headwinds of peak cheap energy on top of massive fraud and swindling. The markets can only blow up. When the wreckage clears and new, smaller markets form, as they will, they must operate differently, with new rules and restraints, because the blow up of today’s markets will be such a trauma that nobody will venture to engage with them if they don’t. A world without simplified and honest capital, commodity, and equity markets would beat a quick path back to a dark age, and in the process a lot of people will die of cold and starvation.

The full workout of all that may be some years further out, but the blowout will commence in 2013. The glue that held these markets together was faith that they meant something — and that faith has been pissed away by fools in high places who drained all the honesty out of them. It was a classic case out of the Joseph Tainter playbook: diminishing returns of ever-increasing complexity addressed with ever-more layers of complexity, larded with systematic lying based on mystifying, opaque jargon, sanctioned statistical misreporting, felonious cronyism, and scuttling of the rule of law. In short, the markets have been taken over in effect by a criminal racketeering syndicate. In doing this, so much resilience has been removed from these market structures that they are riddled with rot, like a mansion infested with carpenter ants. In other words, borrowing a term from Taleb, they are hopelessly fragile. Any little vibration could reduce the whole creaking arrangement into a heap of rubble and ashes. There’s plenty of vibration available out there. Events are humming.

The debt mountains in the USA and

elsewhere far overshadow the equity and commodity market molehills, and unpaid debt will eventually overcome all the forces of untruth. Debt is a subsidiary of the force known as reality. Its will cannot be denied, even by Goldman Sachs, JP Morgan, the US Treasury, and the Federal Open Markets Committee. And the unwinding of unpaid debt, honestly acknowledged or not, will thunder through the system sucking wealth out of advanced societies so efficiently that it will make the Seven Plagues of the Bible look like a flat tire on a sunny day.

So, finally my picks for 2013:

— Dow 4000 (What!? Did he say that!? Again!?). Even the algos will run squealing into the underbrush this time.

— Gold $2500 by 12/31/2013 (and headed higher) after a Q-1 deleveraging swoon. Silver $125. Uncertainty trumps greed and fear.

— Two-way Stagflation — massive asset deflation combined with high energy and food costs. Americans go broke fast, go hungry, go nowhere.

— California, Illinois, and New Jersey beg the broke federal government for bailouts. The federal government pretends to bail them out. Austerity has a field day.

— Despite willingness to do so, the Federal Reserve can no longer “print” money to overcome the deflationary contraction of wealth. They are finally “out of ammunition.” They will try nonetheless. Consequently some nations will stop accepting dollars for trade, possibly the Middle Eastern oil exporters. That would be very bad news.

— Shale oil and gas production stop increasing, possibly turns around to decline. The event hugely demoralizes “energy independence” cornucopians.

— Gasoline shortages return to the USA on a scale last seen in the 1970s. Cause: broken oil market allocation system. Some regions suffer more than others.

— Drought continues in the US heartland. The grain belt withers in 2013. Dixieland cooks like a chicken-fried steak. Food costs go crazy. The American public finally begins to freak out when confronted with $9 boxes of Cheerios.

— A major earthquake hits the West Coast.

Have a nice year everybody.

Apologies for any typos.

The KunstlerCast podcast resumes in January!

____________________________________

For a complete list of books by James Howard Kunstler and purchase links, CLICK HERE.